The Philadelphia Inquirer

By Joseph N. DiStefano

With all the smartphone apps, megamergers and branch closings that have disrupted the banking business, entrenched Philadelphia banks and new competitors are scrambling to gather deposits, train entrepreneurs, and give grants and loans.

— Fulton Bank, based in Lancaster and named for the steamboat developer, has opened a branch in North Philadelphia’s Brewerytown section and is trying to develop its market and boost its community cred by teaching residents to start a small business.

Fulton partner Operation Hope Inc., a national nonprofit that promises to “disrupt poverty,” recruited residents (working moms and military members, among others) for a Fulton “Small Business Bootcamp,” offering business training, financial counseling and technical assistance.

Their plans were judged by a board of peer boot camp students, plus experts — tax lawyer Nikki Johnson-Huston, Kenny Ashe of Sullivan Progress Plaza, Empify CEO Ashley M. Fox, and Fulton Bank Small Business strategist Stephen Markley.

Finalists included Marian Ellis, a Navy reservist, for her proposal MAE (Melanin Actively Elevated), a plan to offer health checks and education to “vulnerable mothers and children”; and Jeanna Baxter, for J3 Maintenance Services, an apartments-management firm.

The winner was Kashmere Brooks-McCoy, a Navy petty officer and owner of BLOOM Network (Be a Lady Overcoming Obstacles in Marriage, Motherhood, Mental Health), which says it has enrolled 500 members “to empower and connect professional women.”

Brooks-McCoy’s mother is newly elected Philadelphia City Council member Kendra Brooks, of the Working Families Party, which ties Fulton to a rising city force.

The bank says 25 have enrolled in the next boot camp, which will start next month.

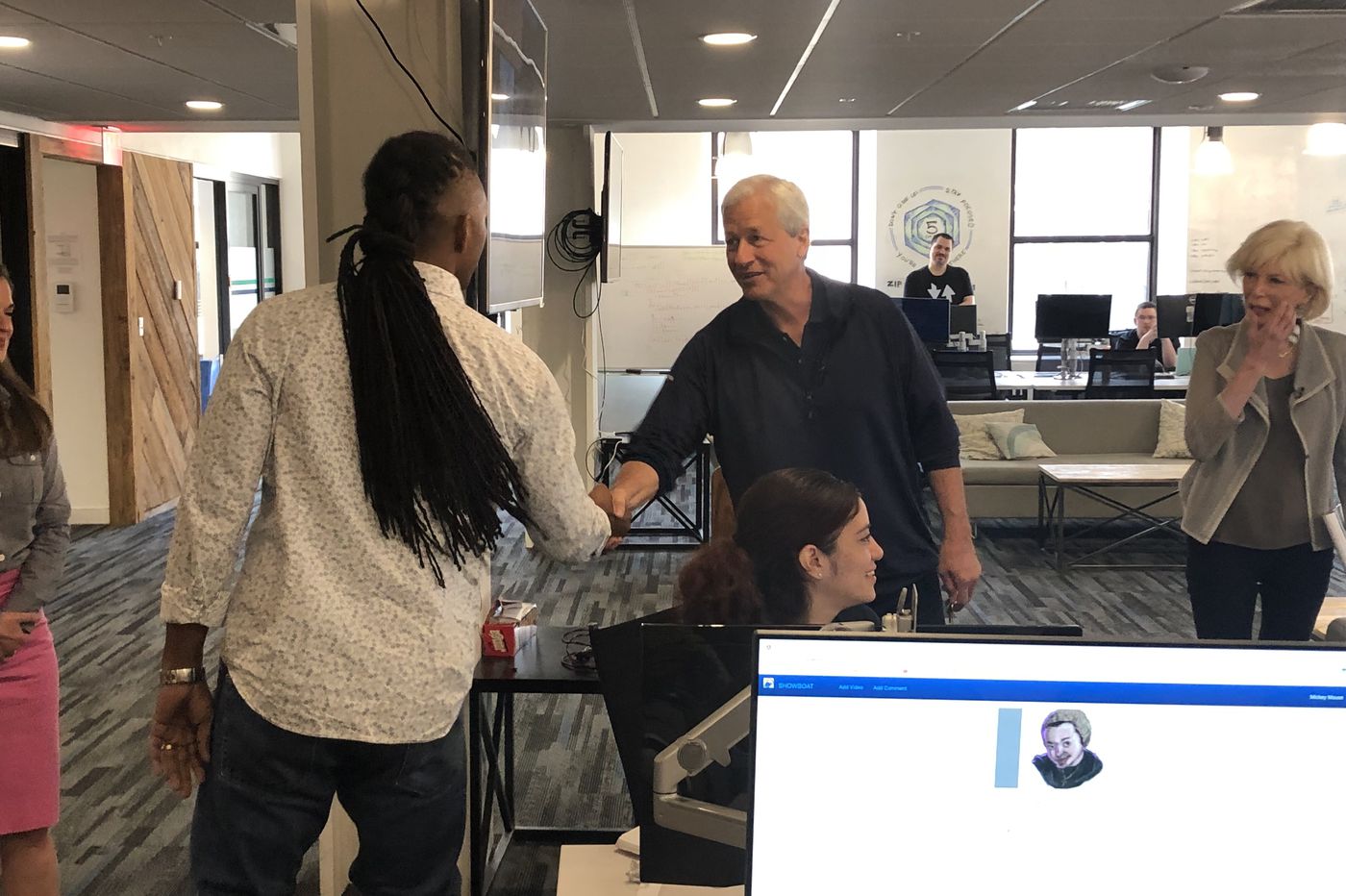

— JPMorgan Chase on Dec. 4 opened a branch at the shopping center on Grays Ferry Avenue, near Penn’s expanding Pennovation business-research complex, and higher-priced “Southwest Center City.”

The nation’s biggest bank, which last winter opened the first of 50 planned offices in the Philadelphia area, used the occasion to announce a $1.5 million grant to the University City District “to expand its West Philadelphia Skills Initiative to North and South Philadelphia” over the next two years.

That eight-year-old program, headed by Matt Bergheiser, takes credit for prepping 1,000 city residents to work “quality jobs” at the universities. The Chase money adds Temple University and the Philadelphia Industrial Development Corp. as partners, and furthers the bank’s ties to the city’s dominant employers.