Every week, we will be publishing labor market industry (LMI) data and important trends to consider in the development of an equitable economic recovery from the COVID-19 crisis. We are always looking for opportunities to learn, grow, and collaborate. Email wpsi@universitycity.org to learn more.

A brief note before we begin this week’s post. Burning Glass Technologies made some updates to their methodology recently, which is caused a brief jump in the number of postings reported in the month of August. We have adjusted our week by week changes to reflect this.

We have spent most of our time digging into the Philadelphia labor market during the COVID crisis. This week, we are going to look beyond the Delaware Valley to see how our jobs market compares to some other cities.

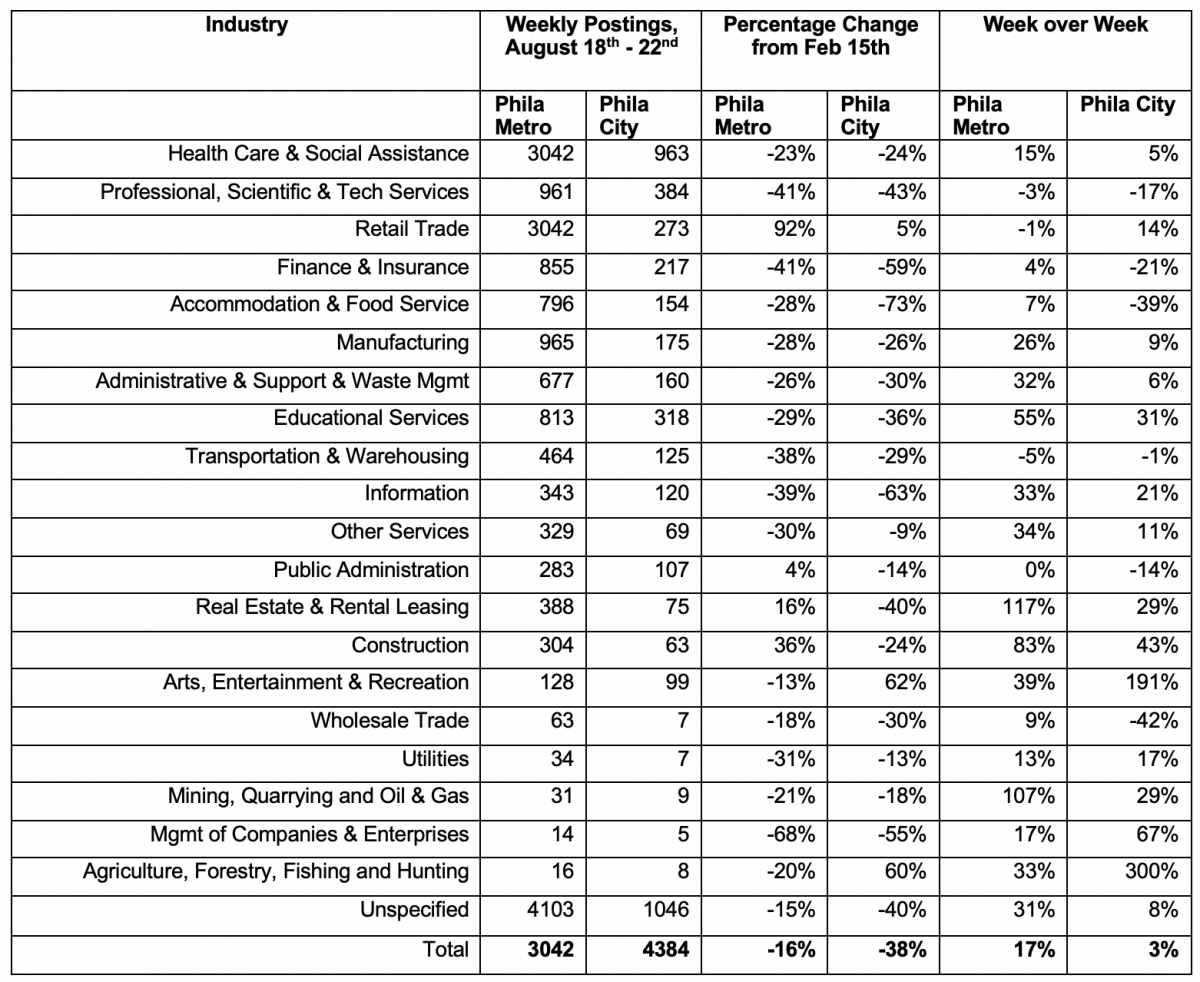

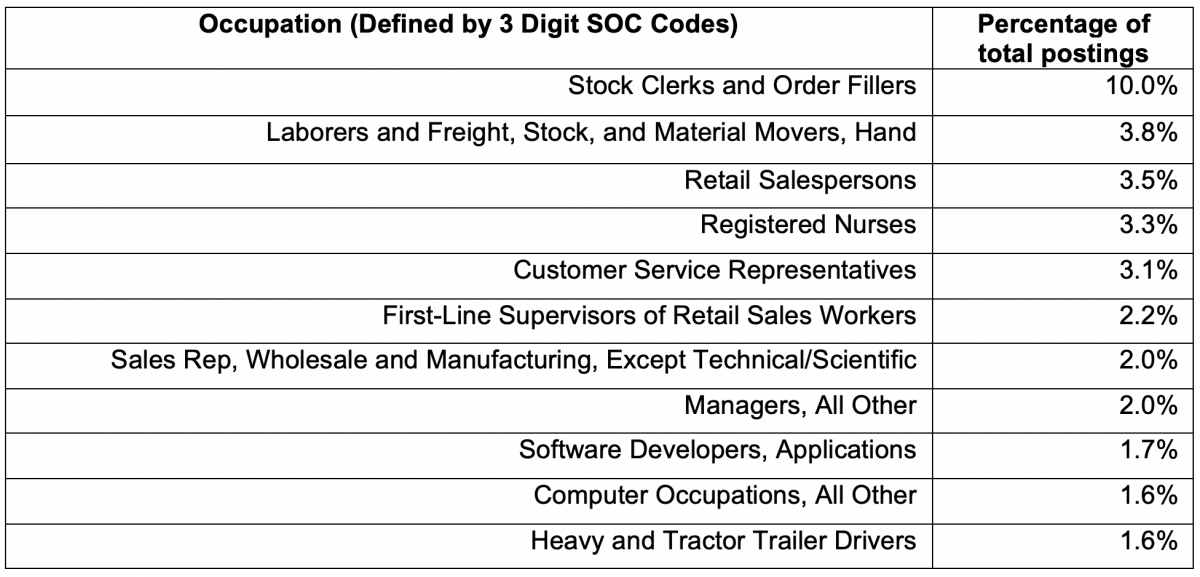

To start, we looked at the top ten occupations (remember last week’s blog about occupations?) in the Philadelphia Metro Area last week, as a percentage of all jobs posted.

If you have been following along this summer, you’ll remember that the biggest driver of jobs has been the retail sector, with companies like Amazon, Target, Lowes, Home Depot and Walmart expanding their distribution capacity to meet increased demand for online or curbside orders. Amazon has had the largest impact of any company in our region, which is again reflected here. Last week, 1 out of every 10 job postings was for Stock Clerks & Order Fillers. The next most common occupations were Laborers, Freight, Stock and Material Movers and Retail Salespersons, which are also concentrated in the same industry.

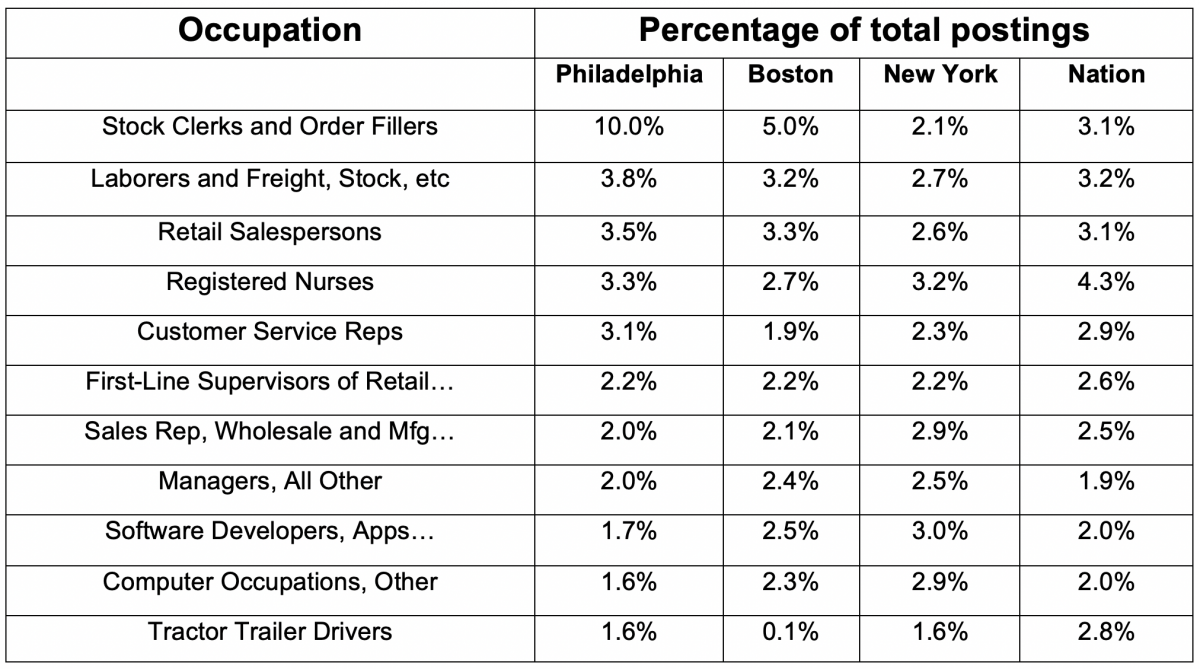

Things start to get interesting when we compare ourselves to other cities, and the country. For this analysis, we focused on New York and Boston, but it’s likely we’d find interesting variations with any set of cities.

The concentration of retail logistics jobs in Philadelphia is much higher than in either Boston or New York, or the nation. Hopefully someone is studying this, but it’s easy to hypothesize some of the reasons that this could be the case. Philadelphia is centrally located along the northeast corridor, making it an ideal place to store goods that can be quickly distributed to a good chunk of the population. The Philadelphia region also has lower land values than either Boston or New York, which likely makes it an appealing place for large warehouses. It’s not that surprising that the site of the shuttered Philadelphia Refinery is slated to be redeveloped into a logistics hub.

In stark contrast to jobs in retail and logistics, Philadelphia has the lowest rates of postings in occupations closely related to technology. Boston and New York both have a higher percentage of weekly postings for Software Developers and Other Computer Occupations, and we are below the national rate as well. While we are only looking at a snapshot, and the gap isn’t huge, this should be a cause for concern. Many of the jobs we see on this list are at risk of automation in the coming decades, and many don’t offer the type of career trajectories that help to move workers and their families to higher earnings. The challenge for Philadelphia will be to grow and attract businesses in sectors that provide growth for both their owners and their workforce, and as workforce providers, we need to be sure that learners of all ages have the foundational and technical skills needed to fill those jobs. The explosive growth in retail and logistics jobs is certainly helping many workers weather the pandemic, but it is unlikely to be a lasting solution to low wage work in Philadelphia.

About the data: Data is sourced from Burning Glass Technologies Labor Insights, unless otherwise noted, covering job postings in the City of Philadelphia and the Philadelphia Metro Statistical Area (MSA), which is comprised of roughly a circle surrounding Trenton, Philadelphia, King of Prussia, Camden, and Wilmington. This data is then compared to a benchmark week of February 9th – 15th, which was the last week before the economic impact of COVID-19 began to be reflected in job posting data.