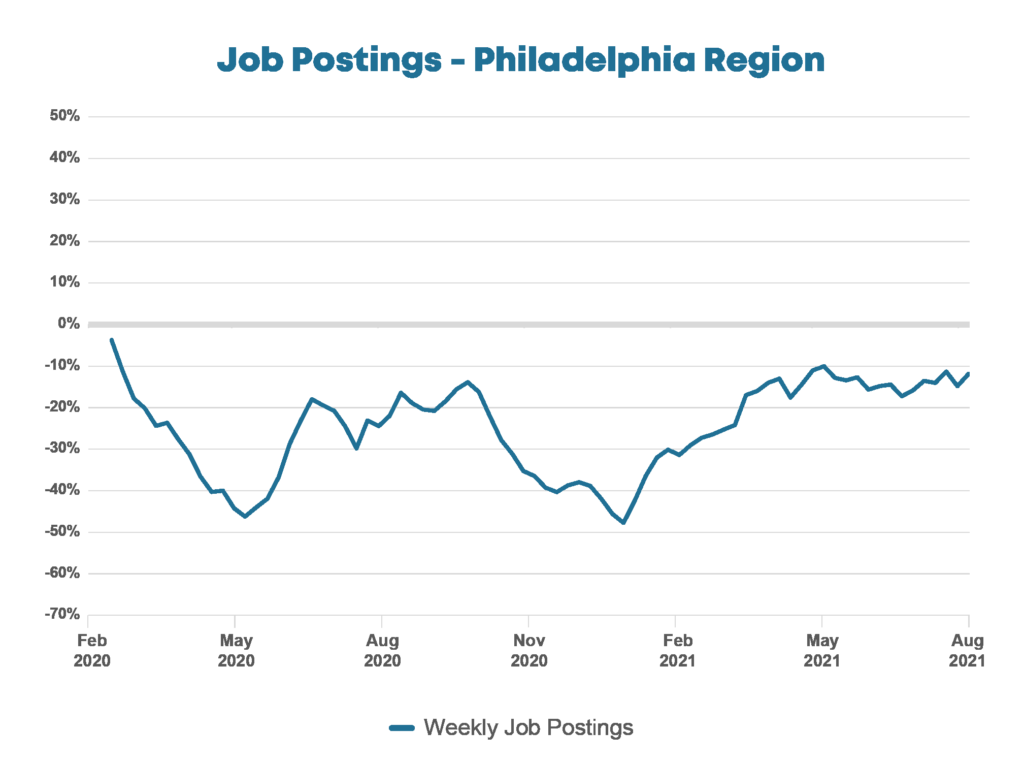

With the explosion of the Delta variant of COVID-19 and the rates for new vaccinations slowing down, some of the optimism many analysts were feeling last spring and in the early summer has faded. Companies that had hoped to bring staff back to offices are adjusting their plans. The Consumer Confidence Index, a measure of consumer sentiment in the coming year, recently showed the first monthly decline in consumer confidence since the number bottomed out at the beginning of the pandemic in March of 2020. And after rebounding to near pre-covid levels early in the summer, the number of new weekly job postings has pulled back in the past few weeks.

Reopening plans at the beginning of the summer brought new job postings up to their highest point since the start of the pandemic, but as of this writing on August 31st, postings remain stubbornly 10-15% below their pre-pandemic peak in the Philadelphia region. This is still significantly higher than the worst periods during the past 16 months when new job postings were down nearly 50% some weeks.

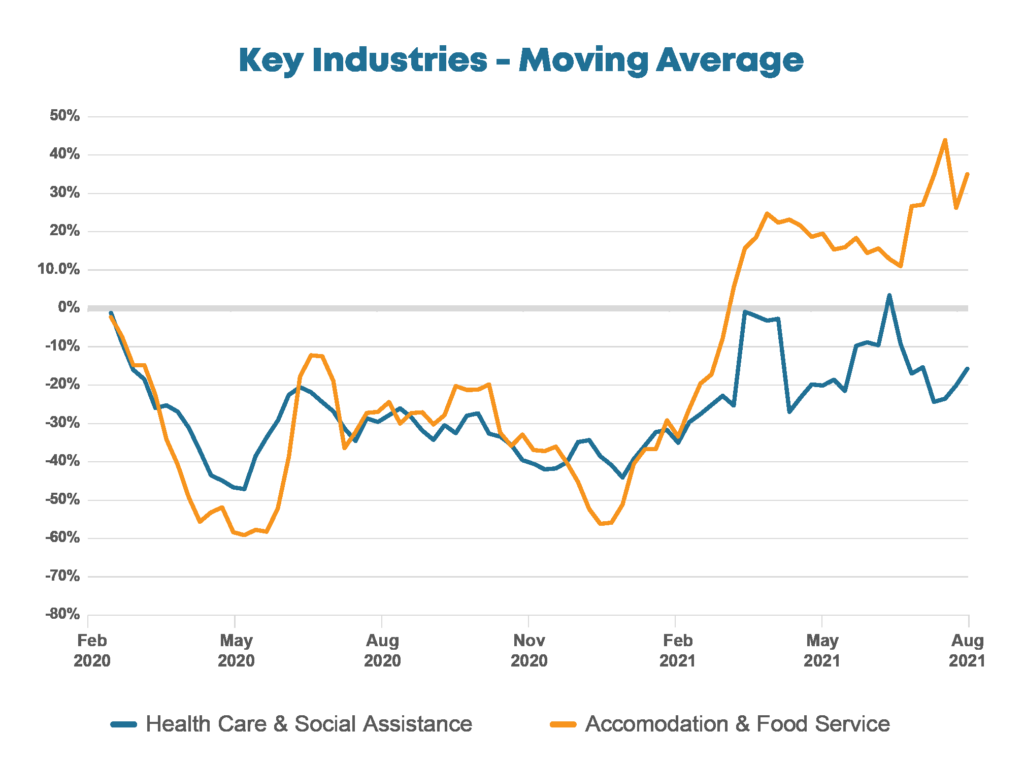

While weekly job postings remain below pre-pandemic highs, some industries have recovered more quickly than others. The impacts of early lockdowns hit customer-facing roles the hardest, especially in the hospitality sector. Since lockdown restrictions were lifted in May of 2021, job postings in the industry have remained well above pre-pandemic levels. Health care job postings are also back to their pre-pandemic levels most weeks. However, both of these sectors could again be hit hard if the Delta variant continues to spread unchecked as it has been in some parts of the country.

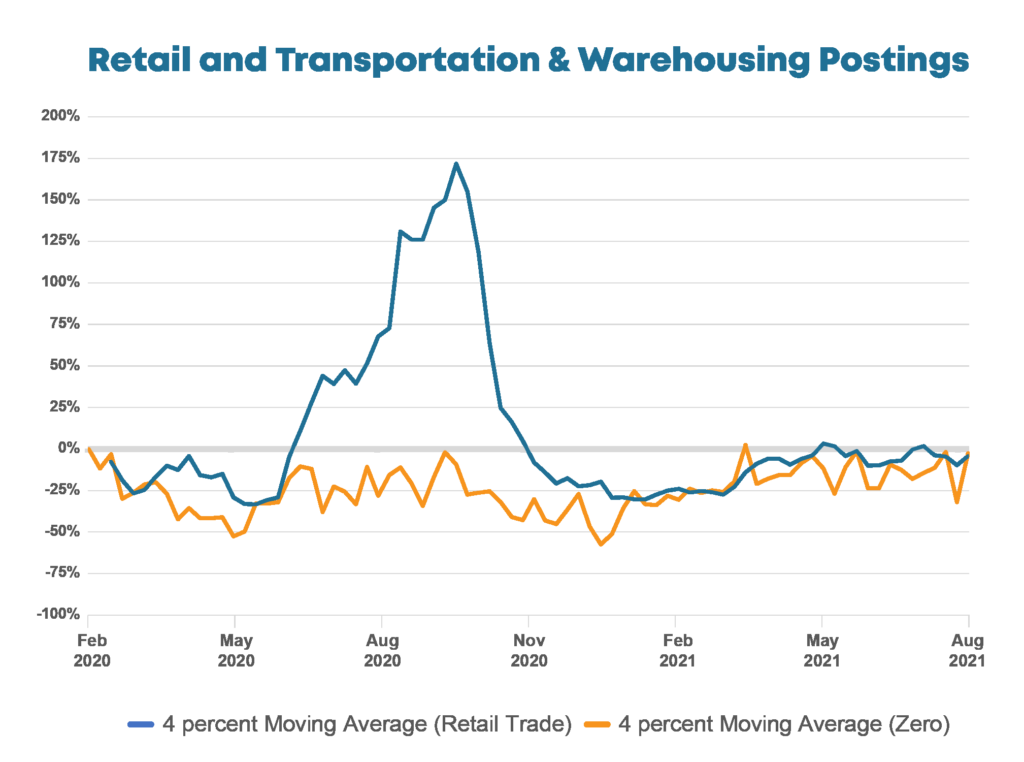

Another sector of the labor market we’ve covered extensively in the past year is the rise of e-commerce, and the explosion of logistics jobs driven by Amazon in the region. Last summer saw weekly job postings in the industry peak out at nearly double pre-pandemic levels. That spike seems to be a one-time occurrence as companies rapidly expanded their warehouse capacity to keep up with online shopping demand. Since lockdowns eased in the spring to allow for full-capacity indoor shopping, weekly postings have stayed steady across the sector.

In the spring, we were hopeful that the worst of the pandemic would be over. However, the Delta variant and low vaccination rates have dampened the outlook for the fall and winter. While full lockdowns seem unlikely to return, delayed returns to in-office work, hesitancy to eat or shop indoors, and rising infection rates may push a full jobs recovery further into the future.

About the data: Data is sourced from Burning Glass Technologies Labor Insights, unless otherwise noted, covering job postings in the City of Philadelphia and the Philadelphia Metro Statistical Area (MSA), which is comprised of roughly a circle surrounding Trenton, Philadelphia, King of Prussia, Camden, and Wilmington. This data is then compared to a benchmark week of February 9th – 15th, 2020 which was the last week before the economic impact of COVID-19 began to be reflected in job posting data.